UK Pensions: How much will your pension pay you in your retirement?

For many people, pensions form an integral component of their retirement planning. However with so many different structures, types of plans and variables involved it’s important to understand exactly how much your pension will provide you in retirement. Before we get started, if you would like to download a copy of our full guide to UK pensions. Still confused? We also offer a complimentary consultation to discuss your UK Pension and personal situation free of charge and help answer any questions you may have.Do you know what your projected income is in retirement?

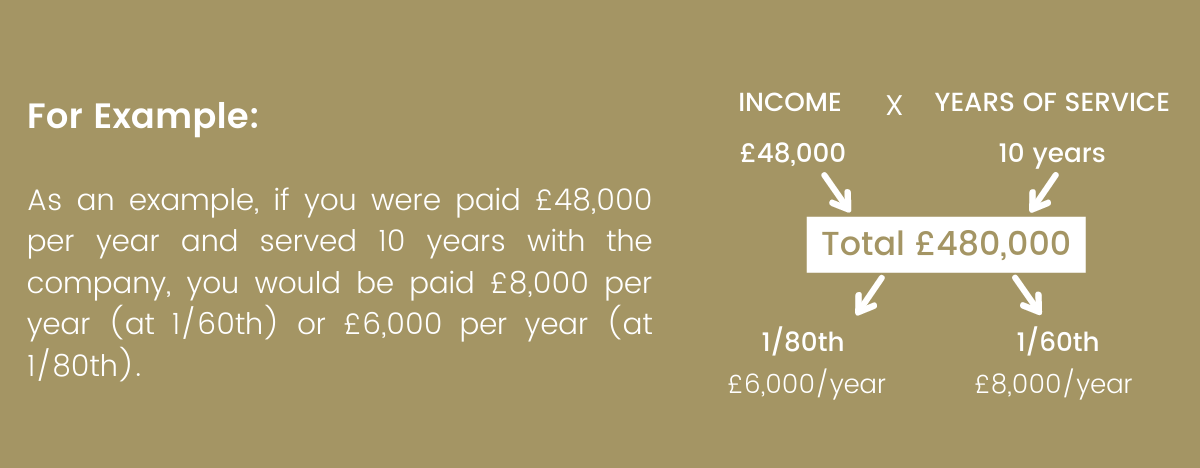

Your projected income will be dependent on the type of pension scheme that you have. If you have a defined benefit pension scheme also known as ‘final salary’ and ‘career average’ schemes, your income will be determined by factors set out in the scheme. It is based on your final or average salary at your time with the employer and the schemes’ accrual rate which is typically 1/60th or 1/80th.How does inflation affect your pension income?

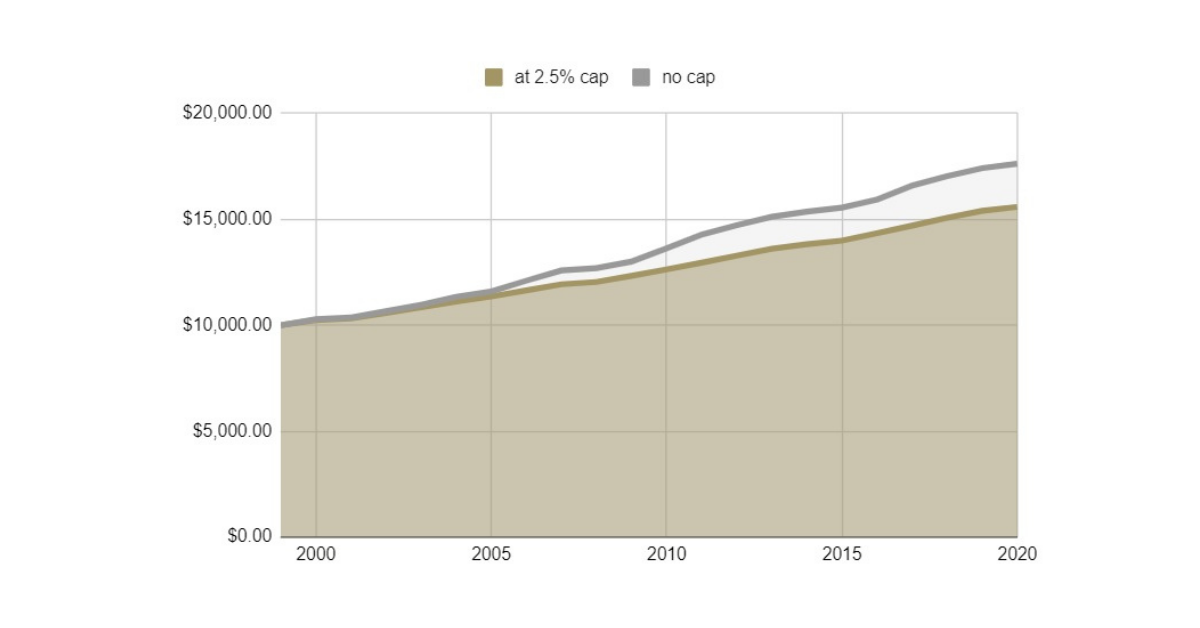

Your pension income will then increase in line with the scheme rules which is typically in line with inflation at RPI (retail price index) sometimes to a maximum of 2.5% or 5% for the older schemes.

*Based on historical RPI data, no cap is where this has not been limited to 2.5%

What happens if I want to take out a lump sum?

With defined benefit schemes a ‘commutation calculation’ is used to calculate how much income that would have been paid during your retirement is required to be given up to take out the immediate tax-free lump sum.

How much will your Defined Benefit Scheme pay you in retirement?

With a defined benefit scheme, the schemes’ normal retirement age is typically 65.

Depending on your scheme, you might be able to take your pension from the age of 55, but this will reduce the amount you get. You might also be able to defer taking your pension, this might mean you get a higher income when you do take it.

These options would need to be discussed with the respective scheme. Once your pension starts to be paid, it will increase each year by a set amount (your scheme rules will tell you by how much) for life but there is no flexibility in the way this income is drawn.

How much will a Defined Contribution Scheme pay you in retirement?

A defined contribution scheme however offers much more flexibility with how benefits are drawn. The current normal retirement age is 55, this is due to increase to 57 in 2028.

Some options to consider:

Annuity

This option allows you to convert your pension into a regular income that will last for life. One of the benefits with this option, similar to a defined benefit scheme is that your income is guaranteed and however long you live, every year you will receive a fixed regular payment until you die. However, if you pass away early, unless you’ve taken out a joint-life, value-protected or guaranteed annuity, usually you won’t be able to leave any to your family, regardless of how much of your fund has been paid out.

Flexi-access drawdown or income drawdown

This is where your money is kept invested until you retire, at which time you then “draw down” or take money out of your pension pot to live on. As your money stays invested (normally in the stock market), unlike an annuity your fund may fall in value depending on how the investments perform. On the flip side, it can also increase in value, increasing your pension pot; however this all depends on the growth of your investment.

Take lump sums from the pension

(Uncrystallised pension lump sums)

Another flexible way to take money from your retirement savings is to leave your money invested and then take lump sums when you require them.

Take the whole pension

This was allowed due to pension freedoms but there are tax considerations to this which need to be looked at.

What is the investment strategy for pensions?

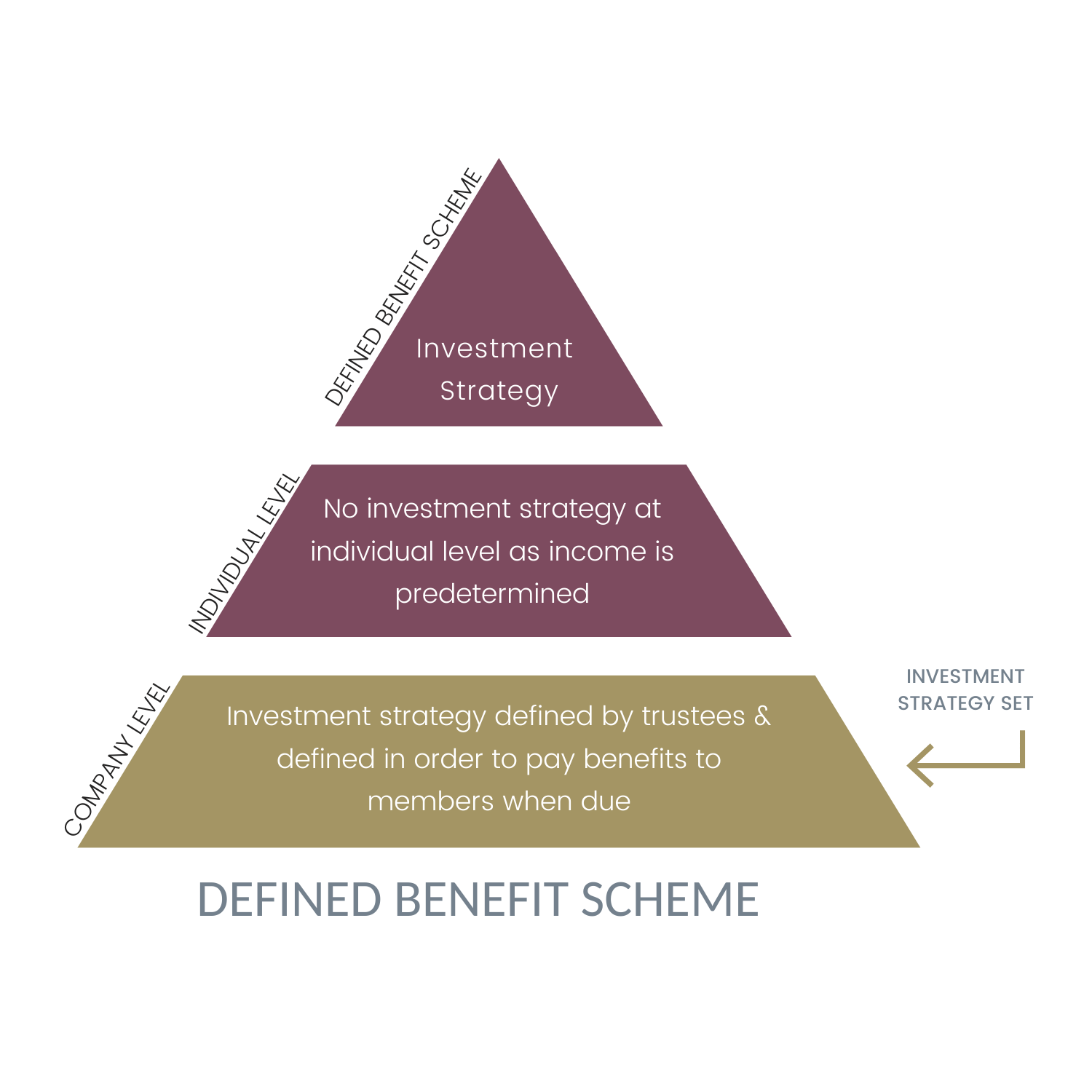

Defined Benefit Scheme Investment Strategy

With a defined benefit scheme there is no investment strategy at the individual level as your income is already predetermined. However, at the company level, every defined benefit scheme has an investment strategy that sets out the basis on which the trustees will decide how to invest the assets of the scheme in order to pay the benefits to members as they fall due.

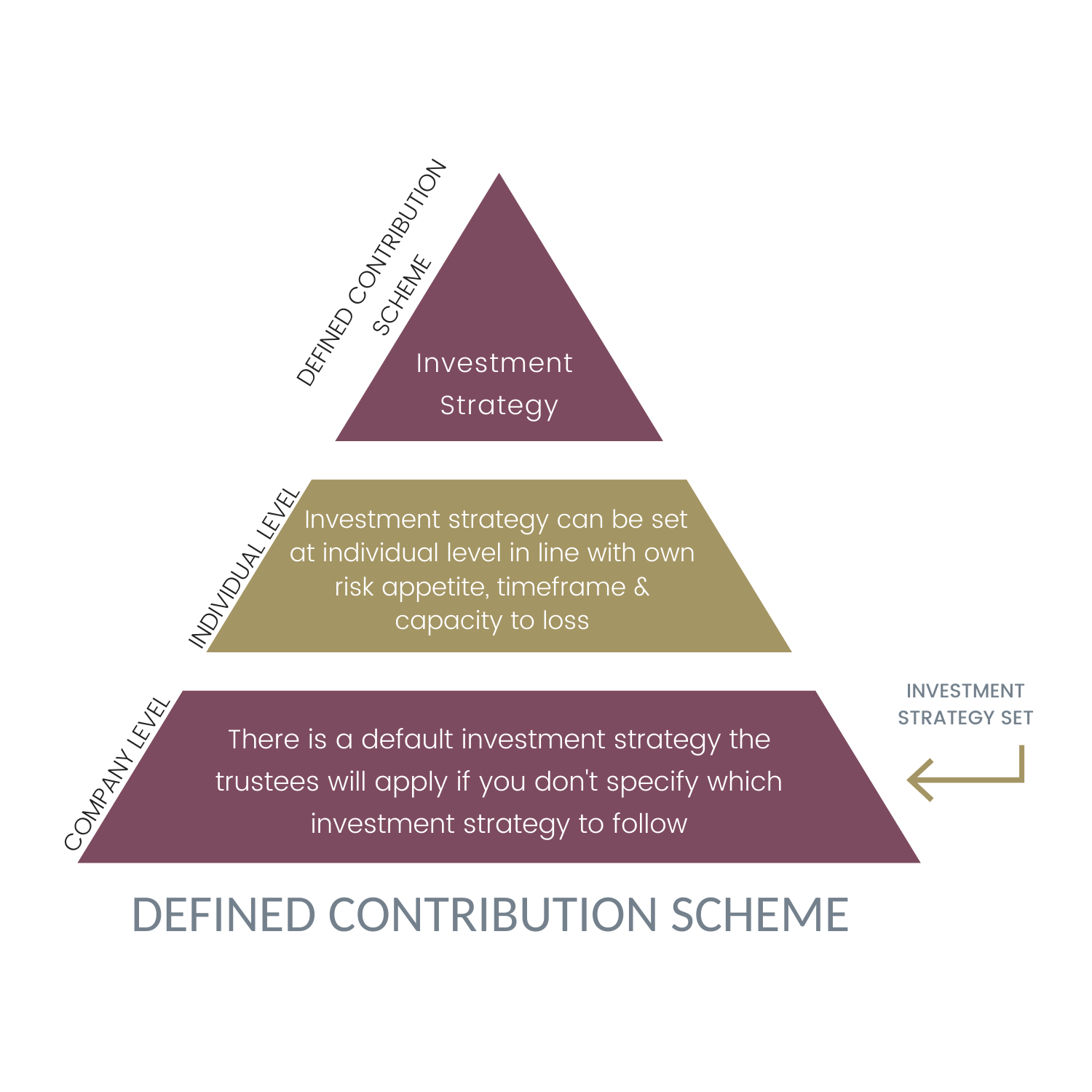

Defined Contribution Scheme Investment Strategy

With a defined contribution scheme your investment strategy should be based on your attitude to risk, capacity to loss and your length until drawing benefits.

This investment strategy needs to be constantly reviewed with market conditions and also updated as your circumstances change.

Want to know more?

You can download a copy of our full guide to UK pensions.

Book a complimentary consultation

We offer a complimentary consultation to discuss your pension and personal situation free of charge and help answer any questions you may have.