What is a financial planner and do you need one?

Simply put, a financial planner in Dubai will understand your current financial position, then creates a plan to help you reach your goals. There are many types of finance professionals, however a financial planner can provide holistic expert advice that’s tailored specifically to your needs and will look at your overall financial position as a whole to help you achieve your financial goals.

Financial planners: What they do

A financial planner firstly understands your current financial needs and long-term goals. In reality, this typically means assessing your current financial situation, understanding your financial goals and helping create a plan to get you there. Financial planners in Dubai can help you reduce spending, pay off debt, and save and invest for the future to help achieve your goals.

Certified financial planners in Dubai offer holistic financial planning advice on everything from budgeting and investing to insurance and retirement planning, with some financial planners also specialising in investments, tax, pensions and various other products.

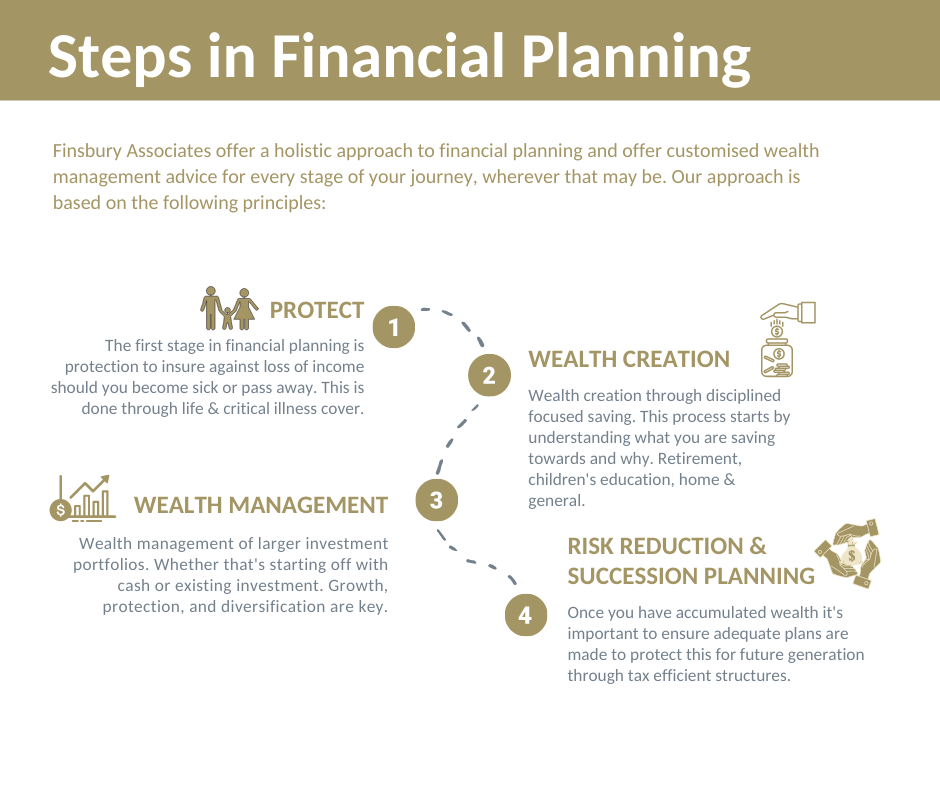

A holistic financial planner such as Finsbury Associates, generally follow the below steps when looking at your wealth journey.

Is my financial advisor qualified?

It’s important to ensure that your financial planner is both licensed and qualified to give you advice. Within Dubai, financial planning firms should be licensed and regulated through either the UAE Insurance Authority, the Dubai Financial Services Authority or the Security and Commodities Authority.

As well as ensuring that the financial firm is regulated, it’s vital to ensure that your financial advisor is qualified with the relevant industry body to give you advice. Firms such as Finsbury Associates ensure that all of their advisors are qualified and complete a minimum of 35 hours continued professional development annually.

You can check your advisor’s qualifications with their appropriate body i.e. the CII (Chartered Institute of Insurance) and CISI (Chartered Institute of Securities and Investment) by typing in their name.

Why use a financial planner in Dubai?

Financial planners can help you achieve your financial goals, keeping you both on track and accountable. Good financial planners will first review your financial situation, discussing your goals and then develop a strategic, holistic plan to help you achieve them.

They can help with specific financial goals such as:

- Retirement planning

- General saving

- Estate planning

- Tax planning

- Repatriation and expatriation

- Education planning

- Lump sum investment

- Pension planning

Financial planners are impartial and a good financial planner should actively review a client’s portfolio at least once a quarter, checking in to ensure that it is actively rebalanced and you are on track to achieve your goals. By regularly reviewing clients, they can help modify your investment strategy if your situation changes e.g. if you lose your job, have a family, repatriate or receive an inheritance.

Financial planners have access to the latest market updates and insights and much like you would consult a doctor, accountant or specialist, they can provide specialist holistic advice and save you time, providing you with the latest information.

Do you need a financial planner in Dubai?

Generally speaking, the more complex your financial situation, especially as an expat, the more likely you are to benefit from a financial planner in Dubai.

Financial planners can provide an objective perspective, and bring expertise to decisions about how you should invest your money, what your financial priorities should be and what sort of insurance coverage and other protections you need. A financial planner can be especially helpful when you’re faced with a life change — think marriage, a divorce , having children or an inheritance.

Firms such as Finsbury Associates have specialists in all of the above areas, to ensure that you find someone you are comfortable with. For example, Unity Wealth is a division with female-only advisors who specialise in financial planning for women going through divorce, bereavement, female executives and more.

How much do financial planners charge?

Before you enter a relationship, ensure that you are clear on the advisors fees and charges and ensure these are open and transparent, as otherwise this can significantly affect your investment outcomes.

Financial planners generally charge an annual management fee, typically 1% of your portfolio balance for the year, though some can charge significantly more so it is worth checking the terms carefully. The initial consultation to discuss your needs and their services is usually free.

Some financial planners will also be paid through charges built into funds that they invest you into, therefore it is important to clarify whether you are going into a clean share class. Finsbury Associates investment approach is to invest in clean share classes to ensure maximum returns for clients.

Working with a financial planner

An initial meeting with a financial planner is a chance to meet your advisor in person and see if your goals and objectives are aligned and a good fit. An initial consultation should be free of charge and your advisor should go through your current financial picture with you including any income, expenditure, property and your personal situation. They will also talk through your financial plans, objectives and risk tolerance. From this, they should then present a strategy and next steps.

During this initial consultation, you should also discuss the fee structure, the advisor’s license and qualifications, how much you can expect to pay, how the financial plan will be presented and how often to expect ongoing communication.

Your financial planner should be in regular contact with you, at least once a quarter and you should update your planner with any changes to your financial situation.

Want to know more?

Finsbury Associates are a licensed, qualified financial planning firm based in Dubai, specialising in expats and holistic financial planning. If you would like to book a free consultation with one of the team, please get in touch.