Critical Illness & Life Insurance

Protecting your Family’s Future

Affordable Life insurance for UAE expats giving peace of mind and protection for your family

Get a FREE Quote

Working with the regions leading providers:

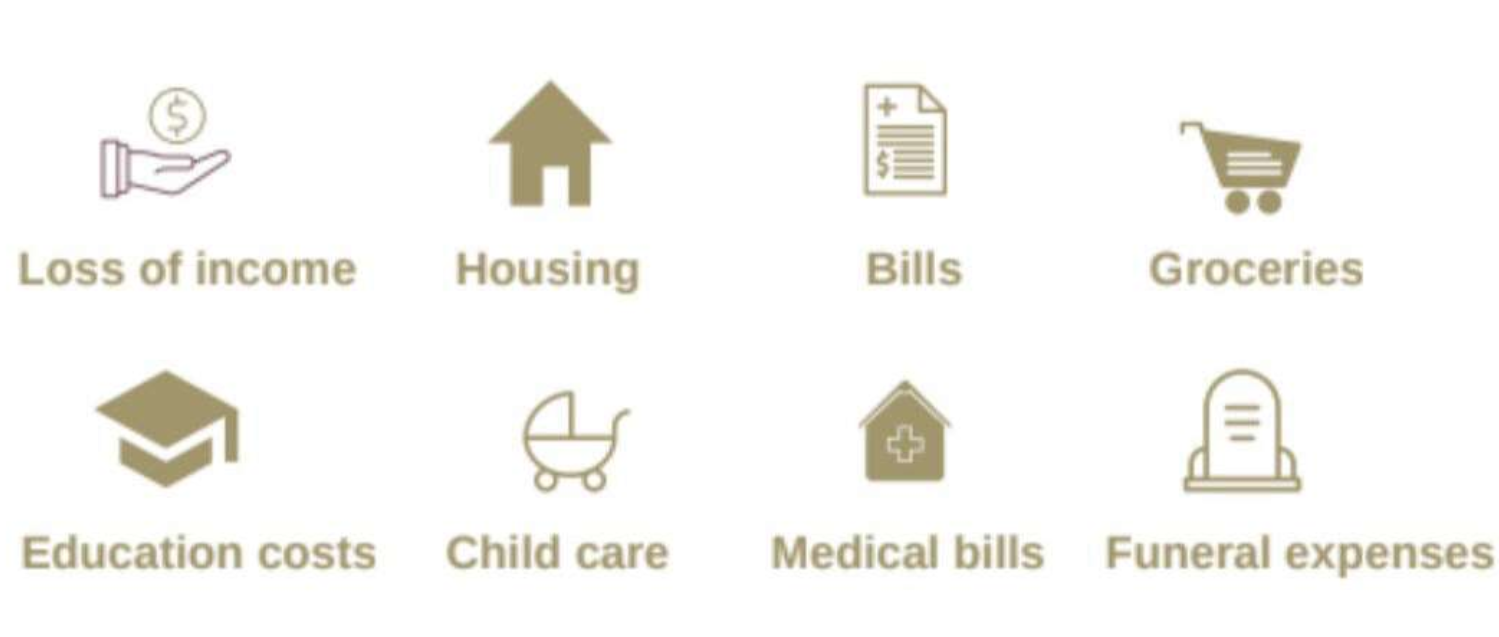

Life insurance can help you with:

Complete coverage for your family when they need it most

“I’ve been with Finsbury for the past 2 years and I am very happy with their service. After being mis-sold plans from other adviser’s, finally, I have found someone that actually cares.”

Life insurance in 5 mins

Critical illness in 5 mins

What is life insurance?

Life insurance provides a financial pay out to your loved ones should you die during the policy term. So if you take out life insurance and pass away before the policy ends then a claim can be made.

What is critical illness cover?

Critical illness cover is an insurance policy that provides a lump sum payment if you are diagnosed with one of the specified life-altering illnesses, such as heart attacks, stroke, or cancer.

Whilst your medical insurance policy may cover some or all of your hospital bills, it won’t cover your living costs and loss of income whilst you recuperate.

There are also joint policies which cover both life insurance and critical illness and pay out on on whichever event occurs first.

Why do you need it?

Although most people have insurance to cover the cost of their home or car, worryingly many people don’t have life insurance or critical illness cover.

Whether you are the primary income earner, a stay at home parent, or a single person, insurance is essential. It ensures you or your family can still pay for everyday essential items such as housing, schooling, groceries, health care or even funeral expenses.

Further Resources

[5-min read] Securing Your Family’s Future: How Critical Illness Insurance Can Be a Lifeline in the UAE

Securing our family's future is a top priority. Unexpected health issues can disrupt our lives and impact our financial stability. This is where Critical Illness Insurance can play a crucial role in providing a safety net. In this informative blog, we will explore the...

[3-min read] Is a Jumbo Life Insurance Policy the Right Choice For Your Portfolio?

Is a Jumbo Life Insurance Policy the Right Choice For Your Portfolio? Jumbo life insurance gets its name from its significantly high value. Also known as ‘universal life insurance’, the cover for a jumbo life insurance policy often falls in the range between $1-$100...

![[5-min read] Securing Your Family’s Future: How Critical Illness Insurance Can Be a Lifeline in the UAE](https://finsbury-associates.com/wp-content/uploads/2023/09/Securing-Your-Familys-Future-How-Critical-Illness-Insurance-Can-Be-a-Lifeline-in-the-UAE-400x250.png)

![[3-min read] Is a Jumbo Life Insurance Policy the Right Choice For Your Portfolio?](https://finsbury-associates.com/wp-content/uploads/2023/03/JumboInsuraace_v1_FBlog-400x250.png)